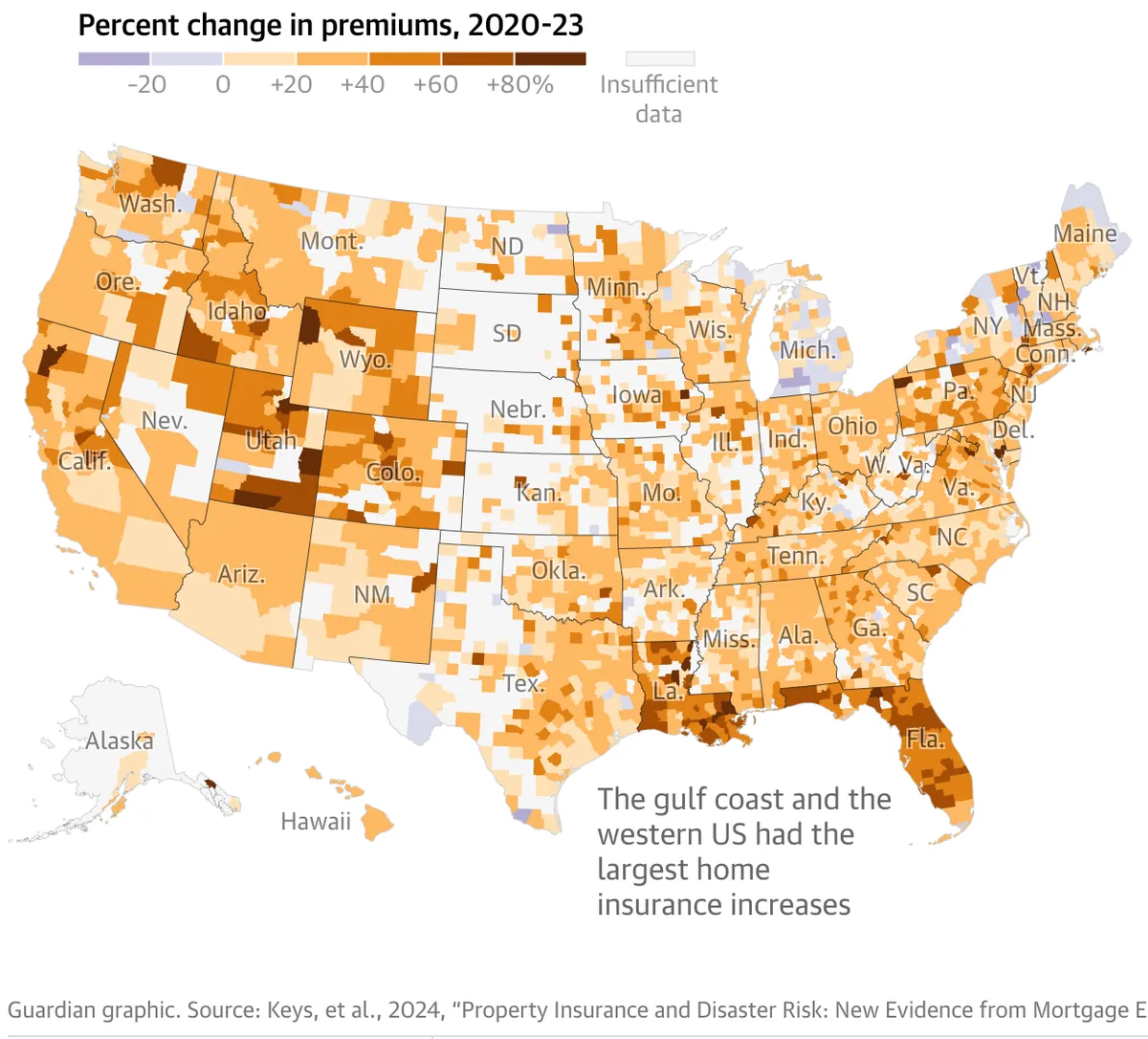

In recent years, homeowners across the United States have faced sharp increases in property insurance costs. A groundbreaking study by Benjamin J. Keys and Philip Mulder, published by the National Bureau of Economic Research, reveals a staggering 33% increase in average premiums between 2020 and 2023. These rising costs, driven by escalating disaster risks, are reshaping how families approach financial and disaster preparedness.

What’s Driving the Spike in Premiums?

The study highlights a growing relationship between climate-related disaster risks and insurance costs. Key findings include:

-

A one-standard-deviation increase in disaster risk now adds approximately $500 to annual premiums, up from $300 in 2018.

-

By 2053, families in high-risk areas could face annual premium increases of $700 due to worsening climate conditions.

-

Reinsurance costs—secondary insurance that insurers purchase to hedge against catastrophic risks—have doubled in the past five years, with these costs passed directly to homeowners.

These factors underline an urgent reality: families in disaster-prone areas are disproportionately bearing the financial burden of climate change.

The Regional Impact: Who Is Most Affected?

Geography plays a pivotal role in determining insurance costs. Coastal regions, particularly along the Gulf of Mexico and the East Coast, experience the highest premiums due to hurricane and flood risks. Similarly, wildfire-prone areas in the West and tornado-exposed zones in the Great Plains face significant cost increases. For example, residents in Florida and Texas have seen premium hikes as high as $1,000 annually since 2018.

What Can Families Do to Prepare?

Rising premiums are just one part of the challenge. Families must also prepare for the possibility of catastrophic events themselves. At Perci, we’re committed to empowering families to feel confident and ready for emergencies with practical solutions like the Perci Vest and Perci App. Here’s how you can take action today:

-

Understand Your Risk: Use tools like FEMA’s National Risk Index or First Street Foundation’s models to evaluate your disaster exposure.

-

Review Your Insurance Policy: Ensure your coverage matches the current risks in your area and includes any necessary add-ons like flood or wildfire insurance.

-

Prepare for Emergencies: Equip yourself with essential tools like the Perci Vest, which provides hands-free access to 25 emergency items, ensuring safety during evacuation or shelter-in-place scenarios.

How Perci Can Help

The Perci Vest is more than an evacuation tool; it’s peace of mind. Designed with families in mind, it ensures that even in the chaos of a disaster, you have everything you need to act quickly and safely. Coupled with the Perci App, which provides real-time alerts and planning tools, you can confidently face emergencies without second-guessing your preparedness.

Take Control of Your Preparedness

The costs of inaction are clear: rising insurance premiums are just the tip of the iceberg in a world of increasing climate risks. By investing in preparedness today, you can mitigate both financial and personal risks.

Explore the Perci Vest and Perci App today to safeguard your family against the unexpected. Together, let’s face disaster risks with confidence and readiness.